It’s that time of year again. In the parts of our country with a full four seasons, we’re raking leaves, winterizing sprinkler systems, and switching to heavier clothing. The clocks are about to change once again, this time moving back an hour.

In the current incarnation of Fall, we’re also being bombarded with messages approved by individuals aspiring to obtain or retain public office.

On this day in particular, we’ve just celebrated Halloween and are entering the month that houses Thanksgiving. This also means that there are just two months left until the end of the year, leaving a fading opportunity to setup a Solo 401k plan in time to make contributions for 2018.

While it is true that contributions to a plan can be made up until the employer’s tax filing deadline, unlike with IRAs the plan must have been setup by end of the year for which contributions are to be made. In other words, if you want to make contributions for 2018, you can do so until tax day in 2019, but only if the plan was created on or before 12/31/2018. That deadline is what makes this time of year the rush season for new Solo 401k plan participants and plan providers.

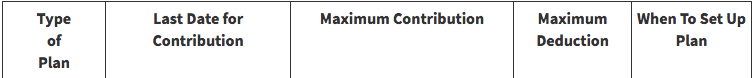

IRS publication 560 has a useful chart displaying contribution and setup deadlines for various structures. See Table 1 in the following link: https://www.irs.gov/publications/p560

401k plans, including what are commonly referred to as “Solo 401k plans” are addressed under the category “Qualified Plan: Defined Contribution Plan,” as shown below.

Setting up and contributing to a Solo 401k can literally save you tens of thousands of dollars on your tax bill for this year and aggressively accelerate you down your path to becoming financially independent. This is one of the best ways to plan financially for the future, an increasingly important step in today’s world of uncertainty and dwindling social security reserves. Every January we have to break the news of this deadline to hopeful members of the self-employed calling or emailing to setup plans and make contributions for the previous year. Our hope is that this message will help decrease the number of disappointed people who were just a little too late.